Cognitive Biases in Work and Life

MySkills Academy will review following cognitive biases: affinity bias, confirmation bias, Dunning Kruger effect, loss aversion bias, curse of knowledge, conformity bias, planning fallacy, framing bias, conservatism bias, authority bias, ostrich effect and the denomination effect. Moreover, we will give some examples and introduce tips on how to avoid them. What is bias? Simply talking, it’s something which impacts our rational and objective behaviour and decision making process. Let’s review some popular cognitive biases, so get a cup of tea and enjoy 🙂

Affinity Bias and Confirmation Bias

Affinity bias is a typical example of cognitive biases for people all over the world – we like people who are similar to us. Human beings are social creatures, but it’s much easier to communicate with somebody who looks or behaves like you. For example, a person having the same nationality as you, also wearing glasses and a beard or simply having the same hobby as you. You are most likely to trust this person and accept his/her arguments without any justification.

The most important thing is to prevent the negative impact of affinity bias in companies, especially during interviews. The easiest way is to take some time to analyse the provided information or ask other colleagues to express their opinions or even participate in discussions. Therefore, the decision will be less biased and more objective, making the affinity bias less significant.

Professionals are often affected by the Confirmation bias, which means that they tend to make their strategies, decisions or work-related processes based on their own assumptions, but not on research data or facts. Moreover, they are finding all kinds of ways to justify their ideas by doing “post-facto research” (after the strategy was implemented). In this way, you are least likely to find a solution but will be able to protect your own opinion, which though might not be the perfect choice and could fail in practice. Confirmation bias is also very common for students working on different projects and trying to save some time learning the theory.

Compared to other cognitive biases, confirmation bias is easy to prevent – you need to always begin with research and build your ideas based on the analyzed data, even if you think that you don’t need it.

Dunning Kruger Effect and Loss Aversion

The Dunning Kruger Effect is a cognitive bias that creates an overestimation of people’s own skills and knowledge, especially in the areas where they have little or even no experience at all. Simply talking, humans can be very proud, assuming to be a professional in all fields. A common example of the Dunning Kruger Effect from the business world is the superior thinking that he/she knows more than their subordinates in a very specific or technical subject, despite not having the advanced skills required.

Cognitive biases like the Dunning Kruger Effect is very difficult to avoid, because of human nature. We would advise you to use rational thinking in order to evaluate your knowledge fairly. However, it does not always help, thus try to listen and accept arguments and comments of other people.

Loss Aversion is a typical representative of business cognitive biases but could also be present in daily life. This bias creates a fear of losing an investment, which ultimately overcomes the desire to reach higher profit. Loss aversion bias blurs your ability to make an objective decision, from which you might profit more in the long run. If we take business investors as an example, many of them would prefer not to lose 5000 Euro, rather than earn 10 000 Euro. An example of Loss aversion bias from daily life is buying stocks or bonds, which could bring much more money than keeping savings in banks.

How to avoid this bias? The solution is more simple than you might have thought: The more often you lose money – the lower your fear of losing an investment will get. Still, avoiding other cognitive biases is not that “easy” 🙂

Curse of Knowledge and Conformity Bias

The Curse of Knowledge – is a typical cognitive bias not only within the business world but also daily life. Human beings are constantly developing and usually have never finished learning something new. People affected by this bias tend to forget that they did not have all the current knowledge before, ultimately assuming that everyone else also has the same knowledge. The more things become more obvious and clear for that person, the more he or she assumes it is also for others.

It is very important to minimize the effect of this cognitive bias, especially in business life. However, in most of the cases it is only possible to achieve with the help of direct feedback and open conversation. Very often employees are afraid to ask for clarification of some tasks or to confess that they don’t know something, leaving their superior in a different belief. That is why, Curse of Knowledge is one of the cognitive biases most difficult to avoid in the business area.

Conformity Bias – without any doubts your decision making has been negatively impacted by this cognitive bias before. Conformity bias is an effect of herd thinking, which forces us to follow the opinion of the majority even if we, deep down, disagree. Cognitive biases like this one are very dangerous in all fields of our life, as they push us away from our own decisions, thus creating regrets that could follow us for many years. Moreover, you can observe the effect of Conformity bias within a company’s process, as it kills creativity and ultimately the uniqueness of most business models, advertisements, technical features etc.

As a result, a majority of today’s products and services have lost their true USPs (Unique Selling Proposition) and are perceived as very similar to each other. In this case, the development of independent, creative thinking is crucial for the future of businesses. As an example, companies from Eastern countries, proactively motivated their employees to share their own ideas for additional rewards. How do you like this approach to defeat cognitive biases? 🙂

Planning Fallacy and Framing Bias

Planning fallacy is a cognitive bias which affects our adequate decision making process and creates an additional source for stress, forcing us to set up unrealistic expectations over the progress of our planned targets. Normally, people tend to overestimate their own availability, only considering positive outcome scenarios for all their scheduled activities. This bias causes a set-up of non-realistic deadlines, thus leading to overworking in most of the cases.

The solution is very simple: The implementation of more flexible deadlines and the mental freedom to say “No” to some requests, if you anticipate that something could go wrong.

One of the very famous cognitive biases is Framing bias, which affects the perception of the same information, if it was presented in different ways. For example, investors are most likely to accept the proposal if you tell them that it has a 75% chance to succeed. While vice versa, they will be less interested in the offer, if presented with a 25% chance to fail. Basically, the conditions of the offer do not differ, but the psychological impact of “success vs failure perception” creates a significant difference in the final decision making process.

Framing bias is often used in business environments to manipulate people and force them to make a rapid investment. The framing bias can be avoided by analysing and interpreting the data without rushing a decision.

Conservatism Bias and Authority Bias

Conservatism bias affects the decision making process by forcing people to over emphasize on existing, sometimes even outdated, information instead of using new data while adapting to changes. This cognitive bias is very dangerous in a business environment, as it disables a company’s innovative approach and even holds it back from relevant market trends. Thus, companies become more vulnerable to ever-changing environments, which sometimes leads to huge losses or even bankruptcy. A simple example of this conservatism bias can be taken from the mobile phones industry, when several producers were ignoring trends and refused to switch to the development of smartphones, ultimately disappearing from the market entirely.

Minimizing the effect of conservatism bias is not that easy, but if you are a decision maker, we recommend always to do a deep research and discuss the new data with specialists. Also “young blood” is advised to be hired, so the company is able to compare “young maximalistic” and “time-tested” ideas.

Authority bias compels people to accept proposals of experienced people, while ignoring other ideas even if they were better. For example, in working groups the ideas of senior members are almost always prevailing over ideas of other team members. Thus, helpful proposals could be ignored, which causes the loss of potential opportunities.

The cognitive biases of this type have an evident solution: the final decision should be made by an unbiased person that does not know who the owner of the idea is, or even better – by an external specialist. In this case, authority bias can’t affect the decision maker. Another way to minimize the effect of authority bias is a conduction of short SWOT analysis of the proposals, ultimately choosing the objectively best option.

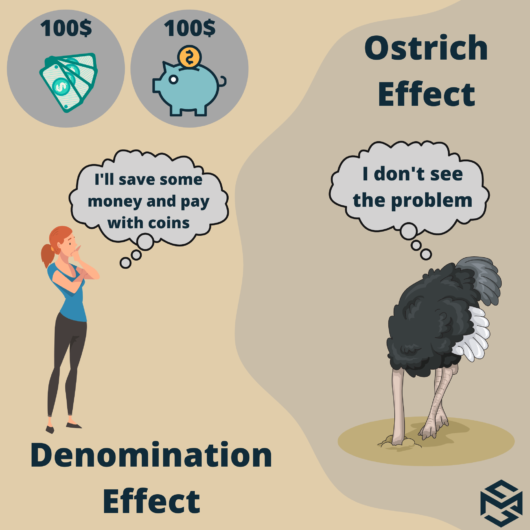

Cognitive Biases: Ostrich & Denomination Effect

The Ostrich effect is a well-known cognitive bias, which pushes people to ignore an obvious problem. Affected people expect the problem to be solved without their participation, even if it’s urgently needed.

Thus, in a business environment it’s important to set the minimum KPIs in order to force the organization to react immediately if the predefined indicators were not reached. However, this bias can sometimes be fruitful in the long-term perspective. If we are talking about investments, the market is in constant flux, thus ignoring some losses could (not always) bring profit in the long run.

The Denomination effect causes the wrong perception about spendings. Thus, people are more likely to spend small bills, rather than the equivalent value in larger bills. The simple example of this cognitive bias is holding a 50 Euro bill for many months in the wallet, while spending all small banknotes.

An efficient budgeting plan is advised to be implemented in order to minimize the denomination effect. We also recommend you to read about it. 😉

We hope that you have enjoyed our topic about cognitive biases in work and life. We have much more in the pipeline – stay tuned 🙂

Do you like our tips? Follow our updates in Facebook 🙂

Continue reading about Key Performance Indicators